Helping You to be Financially Fit For Life.

A Lifestyle focused, Certified Financial Planner with a passion to help you to get more out of life.

During these challenging times we hope that you and your family are well and safe.

From a business perspective our focus remains resolute.

We believe that we are stronger together, and now more than ever we all need to pull together and provide mutual support, encouragement & a sense of community.

We seek to help successful professionals, business owners & happy retirees who have a passion for a healthy & active lifestyle to make wise financial decisions so you can be Financially Fit For Life. Being Financially Fit means creating the life you want for you and your family & doing the things you enjoy doing for as long as you want to do them.

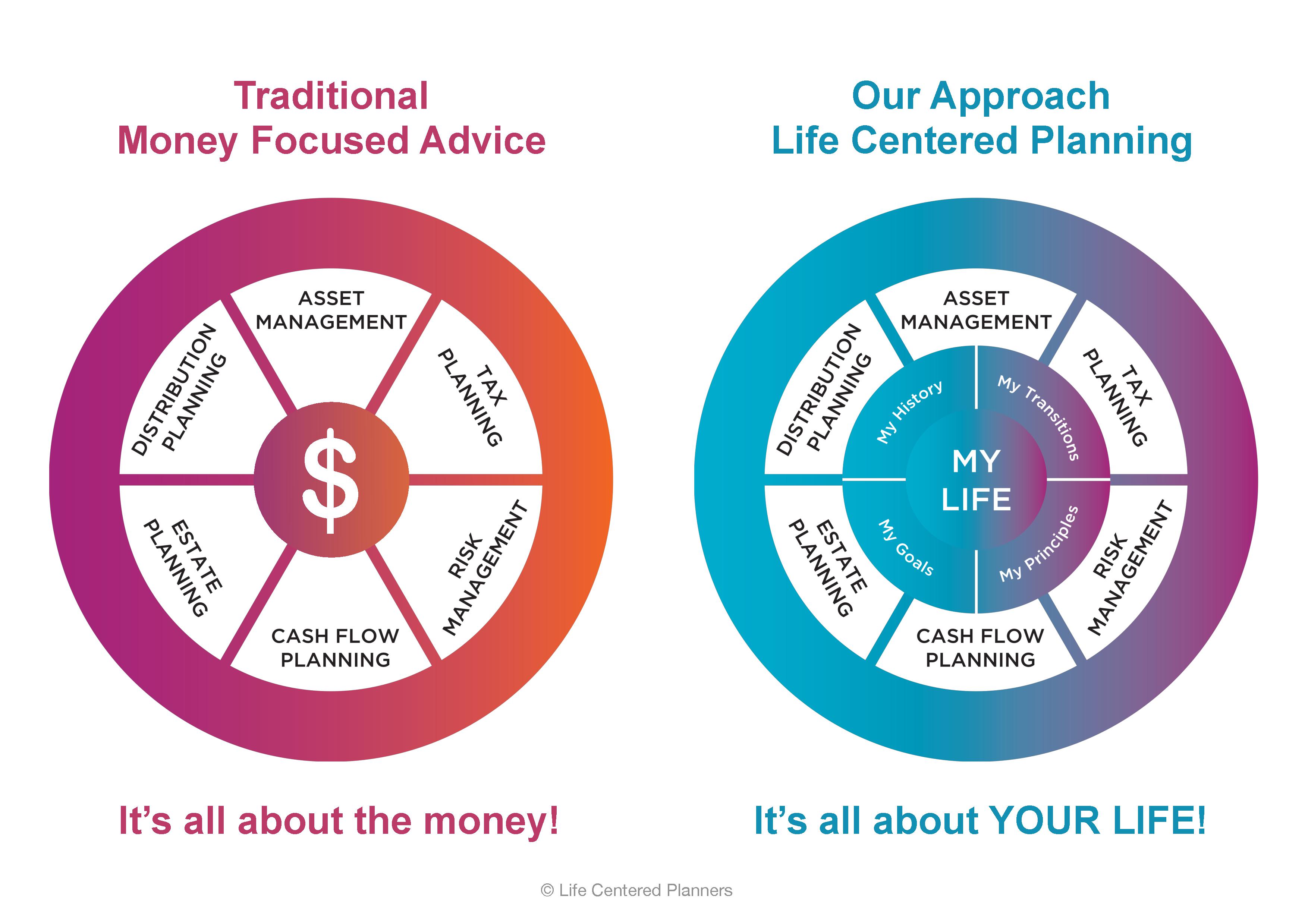

The main problem that we see is that too many financial advisors have created service propositions that put products, particularly investments at the core of the client experience, and their main focus is on “managing your money”. Instead of a service that puts your life at the centre.

A Lifestyle focused approach is not all about your investments. It’s about helping you to identify, achieve and maintain your desired lifestyle without risk of running out of money, or dying with too much. Its about helping you to get and keep a great life.

That’s why we created The Financially Fit For Life Program™.

This unique, Lifestyle focused approach helps you to:

• CLARIFY YOUR LIFE VISION: We help you to gain clarity around what’s possible for you; be it personal, professional or financial, including what it means to you to be financially fit for life, and together we create a plan to make it happen.

• ORGANIZE & OPTIMIZE YOUR MONEY: Your Financial Fitness Plan is designed with one purpose in mind; to help you to get the best life possible with the money you have. Using graphically driven, interactive, easy to understand lifestyle-planning software, we help you make smart choices in all areas of your financial life including: Investments, Tax, Insurance, Debt, Cash Flow, Estate & Giving.

• IMPROVE YOUR PERFORMANCE: We act as your Personal Performance Coach to keep you on track so you can achieve all your important personal & financial goals & ultimately be Financially Fit For Life.

WHAT IS LIFESTYLE/LIFE CENTRED FINANCIAL PLANNING?

- A compelling service that focuses on the very thing that our clients tell us they want most…

- Helping you to identify, achieve and maintain your desired lifestyle…without fear of ever running out of money.

- Lifestyle Financial Planning is Financial Planning done properly!

- It’s not about products and investments.

- They are just tools in the bag used (when required) to get the job done.

- Our job is to create practical financial planning solutions so you can keep your lifestyle.

- Our service is focused on helping you achieve and maintain your lifestyle.

- How does it differ from Traditional Money Focused Financial Planning?

- They say a picture is worth a thousand words. Hopefully these two graphics paint a vivid picture for you:

Your Financially Fit For Life Program is designed to help you to get the best possible life with the money that you have!

If you want to find out more about creating your own Financially Fit for Life Program, we offer a free 90-minute starter session. During this session, we will help you assess your current situation and get to the core of what you really want. We will then decide together if our program and services are a FIT for you and whether to take the next step to create and implement your own Financially Fit For Life Plan.

The Financially Fit For Life Program™ Toolbox includes:

- The Financially Fit For Life Starter Session: This is a 90 minute in depth, complimentary Starter Session where we help you to:

- Clarify Your Life Vision & Life Goals & create a step by step plan to achieve it.

- Download your own Starter Session My Vision of Life Scorecard

- Financially Fitness Checkup. Step on the “financial scale” and get a complete Financial Checkup with recommendations on how to improve your financial fitness including: Investments, Tax, Insurance, Debt, Cash Flow, Estate & Giving.

- Download The Financial Fitness Check up

- Your Financially Fit For Life Plan goes far beyond “basic” financial planning to help you to create the best life possible with the money that you have & includes your personalized:

- My Vision of Life Plan

- Retirement Accumulation Plan

- Retirement Income Plan

- Insurance & Estate Maximization Plan

- Debt Elimination Plan

- Progress Review & Implementation Plan: (You Focus on doing the work that your goals are asking you to do to achieve them, and we hold you Accountable).

- Click to see the Life Events that Require Financial Planning Expertise

- What about the FEES?

- We offer our clients choices that are fair & in their best interests in how they work with us.

- Ask us about our Fees for Financial Planning and Fees For Assets Under Management options.